Smart Asset Growth Made Simple

Explore Life Settlement Assets

Gain a clear understanding of Life Settlement Assets, their unique market advantages, and how they align with long-term financial strategies.

Turn life insurance into secure, high-yield assets

What Is a Life Settlement Asset?

A Life Settlement Asset refers to acquiring Life Insurance contracts, in the form of a Life Settlement. These contracts ultimately pay the owner, providing significant benefits to our clients, as a unique addition to a diversified portfolio.

Unlike traditional financial options, Life Settlements serve as a reliable form of value and offer a level of security unmatched by other assets in fluctuating market dynamics. By purchasing these assets, our clients have the opportunity to enrich their portfolios and promote lasting financial stability.

Titan Horizon Group

Helping institutional and family office investors grow portfolios for over a decade.

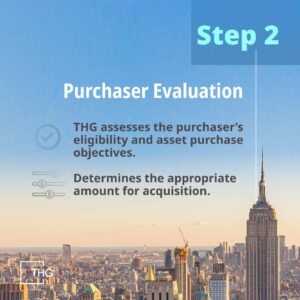

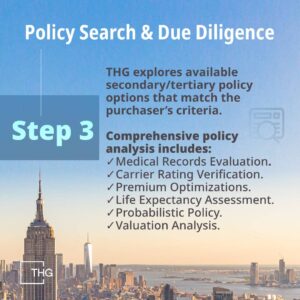

Life Settlement Policy Purchase Process

Evaluate policies in secondary and tertiary markets.

Employ impartial, third-party medical underwriting.

Assess each policy using life expectancy and premium costs to determine its value.

From Concept to Asset Class

The Evolution of Life Settlements

1911 | Grigsby v. Russell

Life insurance policies were recognized as private property, establishing the legal foundation for life settlements as a financial asset.

Read

In 1911, the U.S. Supreme Court ruled in Grigsby v. Russell that the assignment of an insurance policy to someone without an insurable interest in the insured’s life is valid:

- Facts: John Burchard purchased a life insurance policy and asked his surgeon, Dr. Grigsby, to buy it so he could pay for surgery. Burchard paid Grigsby $100 for the policy and agreed to pay the remaining premiums. After Burchard died, his insurance company, Russell, sued Grigsby for the death benefit, claiming it should go to Burchard’s heirs.

- Decision: The Supreme Court ruled that the assignment was valid and that Grigsby was entitled to the proceeds. The court held that life insurance is personal property, and that the insured has the legal right to sell their policy. The court also ruled that a valid insurance policy is not voided by a cessation of insurable interest, unless the policy itself states otherwise.

- Significance: The ruling laid the groundwork for life settlement options.

1980s | Viatical Settlements Emerge

During the AIDS epidemic, terminally ill individuals gained financial relief by selling policies for immediate funds, creating a model for today’s settlements.

Read

Viatical settlements emerged in the 1980s during the AIDS crisis. Terminally ill patients sold their life insurance policies to third parties for cash, offering a way to cover high medical costs and immediate financial needs caused by shortened life expectancies.

Here are some other key points about the history of viatical settlements:

- Taxation: Viatical settlements were not subject to income or capital gains tax due to favorable tax regulations. This was changed in 1996 with the passage of HIPAA, which made viatical settlements tax-exempt.

- Life settlements: In the late 1990s and early 2000s, the life settlement industry began to emerge. Life settlements are similar to viatical settlements, but are for people who are 65 or older and not terminally ill.

- Roots: The history of viatical settlements can be traced back to the 1911 Supreme Court case Grigsby v. Russell, which established that life insurance policies are assets and can be sold.

1990s | Life Settlements Expand

Seniors began selling unwanted policies, turning them into financial resources for care, living expenses, and retirement support.

Read

Life settlements became a practical financial solution for seniors with life insurance policies they no longer needed or could afford. Instead of lapsing or surrendering these policies, seniors could sell them to third-party buyers for immediate financial benefit. This era offered seniors a new way to turn life insurance into a meaningful financial resource.

Key Details:

- Definition: Seniors sell life insurance policies for more than the surrender value but less than the net death benefit.

- Process: The buyer pays future premiums and receives the death benefit upon the insured’s passing.

- Origin: Life settlements emerged as an alternative to surrendering policies, allowing seniors to unlock hidden value.

- Benefits: Immediate cash payments help seniors manage long-term care, medical expenses, and living costs while enhancing financial stability.

2000s | Industry Regulation Strengthens

Consumer protections and transparency measures bolstered investor confidence and solidified Life Settlements as a reliable, regulated asset class.

Read

As the Life Settlement market grew, regulations were introduced to protect both policyholders and investors. This streamlined approach enhanced efficiency, delivering faster settlements and higher payouts, making it easier for policyholders to access funds.

- Higher Payouts for Policyholders: Regulations ensured sellers received better payouts than traditional surrender values, offering financial relief.

- Enhanced Transparency: New rules improved trust in the industry by promoting clear, ethical transactions.

- Institutional Investors Attracted: These regulations enhanced the stability and legitimacy of the market, making life settlements a viable asset class.

- Ethical Standards for Buyers: Third-party buyers were required to adhere to strict ethical standards, ensuring proper management of policies post-acquisition.

The introduction of these regulations played a crucial role in fostering market growth and stability.

Today | Tech-Driven Growth

With $25.5 billion in active policies and $10 billion traded annually, technology has streamlined life settlements, attracting major investors and fueling market growth.

Read

Technological advances have made the market more efficient, while financial institutions like Blackstone are drawn to the non-correlated nature of these assets. Analysts predict continued growth, with further industry development through the 2030s.

- Market Size: $25.5 billion in active policies and $10 billion traded annually.

- Technology: Streamlined processes making Life Settlements more accessible.

- Institutional Investment: Major firms are investing due to stability and low market correlation.

- Regulatory Evolution: Consumer protections and transparency are increasing trust.

- Future Outlook: Analysts predict continued growth and expansion into the 2030s.

This market is expected to grow as more investors recognize the value and stability of Life Settlements.

From Concept to Asset Class

How Life Settlement Assets Benefit You

Steady Portfolio Diversification

Life Settlement Assets offer an alternative pathway to diversify and solidify your portfolio. Clients gain financial security without relying on traditional financial instruments that are subject to market risks. Life Settlement Assets are particularly well suited for those seeking a niche and data-driven alternative asset class.

Valuable Support for Policyholders

Selling a life insurance policy through a life settlement transaction provides immediate financial relief, particularly for individuals without familial support. The lump-sum payment helps alleviate financial burdens such as overdue medical expenses, rising long-term care costs, and retirement plan contributions.

Financial Value for High-Net-Worth Clients

For family offices and high-net-worth individuals already involved in areas such as real estate or private equity, Life Settlement Assets offer comparable yield while bearing a risk level similar to that of a T-Bill. These assets fit seamlessly into portfolios as a reliable tool to reduce overall portfolio risk exposure.

Strategic Wealth Partnering

Partner with Titan Horizon Group

At Titan Horizon Group (THG), we provide more than access to Life Settlement Assets. We serve as your comprehensive partner, offering guidance and expertise to ensure each transaction is executed properly.

As premier Life Settlement contract locators and acquisition specialists, we help accredited and institutional clients realize the unique value that comes with leveraging Life Insurance contracts as assets, while our tax planning services provide added support for long-term wealth transfers and cross-generational legacy planning.

Plan Your Legacy Today

Discover Reliable Financial Growth

Take the next step in diversifying your assets. Connect with us to learn how Life Settlement Assets can provide lasting value for you and your clients.