In a volatile market, family offices need smart wealth strategies. Life settlements offer stable, risk-adjusted...

Read MoreHedging Against Market Volatility:

A Guide for Family Offices

New York, February 5, 2025

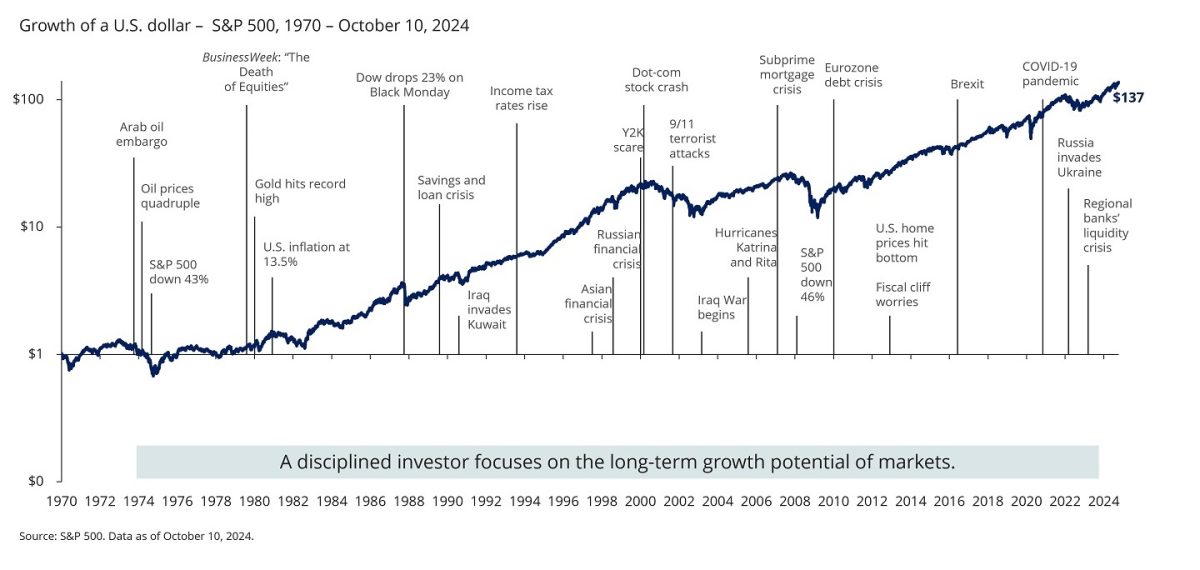

Market volatility continues to be the more considerable hurdle for family offices focused on wealth preservation, growth, and intergenerational planning. Amid rising uncertainties in traditional asset classes, life settlements serve as a reliable alternative, offering attractive risk-adjusted returns with lower market correlation while maintaining a more stable return profile compared to equities.

Understanding the Current Market Landscape

The “super bubble” threatens key markets.

Equities

S&P 500 valuation levels echo pre-crash scenarios, heightening risks.

Real Estate

Overvaluation and rising interest rates erode growth potential.

Bonds

Higher rates compromise their historic safe-haven appeal.

These factors, coupled with geopolitical instability and record global debt exceeding $300 trillion, highlight the need for non-correlated asset classes like life settlements.

Why Life Settlements Make Sense for Family Offices

Life settlements stand apart due to their stability, low market correlation, and ESG-compliant impact. Here’s why family offices are turning to this hidden asset class:

- Non-Market Correlation – Immune to stock market swings and geopolitical disruptions.

- Predictable Returns – Actuarially driven cash flow and clear timelines.

- Diversification and Safety – Spreading assets across policyholder demographics and policy types.

Tax Efficiency – Structuring acquisitions through SPVs optimizes tax outcomes.

Real-World Performance

During the 2008 financial crisis, life settlement portfolios delivered stable 10–15% returns, outperforming equity-heavy portfolios that saw losses exceeding 35%. Similarly, during COVID-19, these assets maintained consistent performance amidst market turmoil.

Action Plan for Family Offices

-

Step 1

Consult Titan Horizon Group to assess risk tolerance and historical performance metrics. -

Step 2

Titan Horizon Group locates a portfolio that aligns with your objectives. -

Step 3

Titan Horizon Group performs rigorous actuarial and legal due diligence on the target portfolio. -

Step 4

Ownership & Beneficiary rights of the underlying life insurance policies are transferred to your family office. -

Step 5

Titan Horizon Group partners with NorthStar Life Services to provide ongoing and post-sale insured tracking and policy management services.

Life settlements present a robust solution for family offices to hedge against volatility, preserve wealth, and achieve stable, long-term growth.

Take the next step

Schedule a consultation with Titan Horizon Group

Start building your life settlement portfolio.

Sources:

Historic market volatility events and strategies to hedge investment risks: https://www.chase.com/personal/investments/learning-and-insights/article/historic-market-volatility-events-and-strategies-to-hedge-investment-risks

Emerging markets are losing their attraction for family offices: https://www.ft.com/content/6388c8e8-d2c4-49ef-8e07-3230a609cff3

As interest rates drop, ultra-rich investors are giving up their cash for risk assets. Here’s what they’re buying: https://www.businessinsider.com/interest-rate-cut-ultra-rich-investors-family-offices-portfolios-buying-2024-9

Related Posts

The Stability of Life Settlements: Why Medical Professionals Should Consider This Alternative Asset Class

Medical professionals seek stability in uncertain markets. Life settlements offer high-yield, uncorrelated growth with minimal...

Read MoreAI Market Volatility and Life Settlements: Navigating 2024’s Financial Landscape

AI is transforming global financial markets, driving unprecedented volatility. With China’s AI alternatives like DeepSeek...

Read MoreNewsletter

Stay Ahead in Life Settlements

Subscribe to our newsletter to get exclusive insights, market updates, and expert analysis from Titan Horizon Group. Stay informed and empowered in the evolving life settlements landscape—delivered directly to your inbox.